Benefits of Hybrid Cloud for Banks

Cloud computing is at the forefront of many organizations, especially now as the pandemic has spurred adoption of digital technologies on a massive scale.

There’s a particular reason why hybrid cloud is on the radar of many banks and financial establishments. Striving to keep up with the market’s expectations for a fast, personalized and secure service, banks and financial services have found it necessary to introduce robust infrastructure for an improved service, such as hybrid clouds.

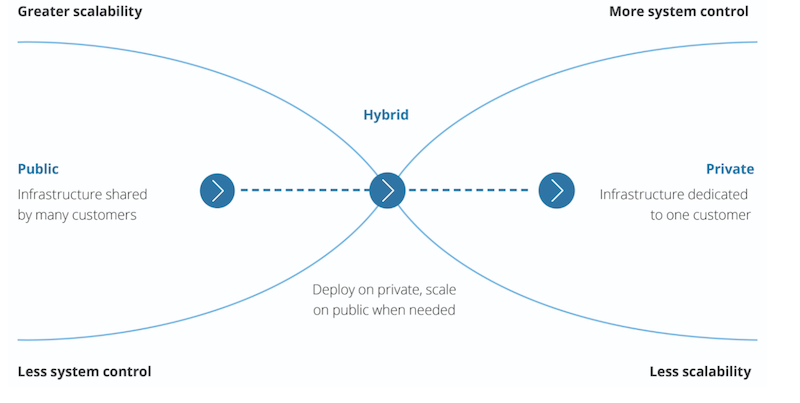

First things first, what is a hybrid cloud? Microsoft, one of the world’s largest cloud solution providers, defines a hybrid cloud as a mix of private and public virtual environments where you can seamlessly move data back and forth.

Bank cloud strategy: image via Deloitte

Private cloud suggests that a company maintains proprietary computing resources, whether on-premise or virtually. In contrast, a public cloud for financial services uses an external provider of virtual infrastructure and services.

Private clouds are typically associated with high levels of privacy, whereas public clouds are known for their scaling capabilities. With a hybrid cloud solution in place, banks can increase resources during peak load, while safeguarding sensitive financial information. Additionally, banks don’t have to invest in additional resources to address peak loads, as is the case when they are limited to a private cloud solution.

READ ALSO: AWS vs MS Azure vs Google Cloud: Feature Overview, Pros and Cons

As such, a mix of private and public solutions allows banks to have the best of both worlds: acting as both a Fort Knox for sensitive data as well as having more powerful computing capacity to provide a robust service for multiple clients. In this way, a hybrid cloud solution addresses the two core needs of financial organizations – a robust service and increased security.

We’ve outlined the two most critical needs that a hybrid cloud can address. Now, let’s dive into more detail and go over some of the main reasons why banks are moving to cloud solutions, focusing on hybrid solutions in particular.

READ ALSO: Four Questions for Blockchain Development Experts

Benefits of hybrid cloud in banking

Cost reduction. A bank hybrid cloud strategy allows banks to transition to a variable expense model instead of a fixed model that comes with an on-premise cloud infrastructure. With a hybrid cloud infrastructure, banks are free to pay for the services they need at a particular period of time. Thus, banks can invest the difference in business development rather than funding their internal infrastructure.

Scalability. With traditional infrastructure, banks are tied to investing in on-premise hardware as the business grows. A hybrid cloud allows banking and financial services to expand their computing capacity without growing pains, which lets them manage unlimited customer requests simultaneously and provide an unparalleled level of service, even during peak workloads.

Resources. Hybrid cloud infrastructure can be managed by a remote IT team specialized in bank hybrid cloud solutions, which can free up your in-house resources to focus on other critical aspects. Tech leaders can hire AWS, MS Azure, Google Cloud Platform, and other specialists in a location with lower developer rates, thus pruning the cost of hiring a tech team.

Market challenges. A bank hybrid cloud solution is proven to be more agile to meet market challenges, which allows banks to react to the changing demands of their clients faster, giving them the opportunity to try out different strategies, improving upon methods proven to be ineffective. As an additional bonus, a hybrid infrastructure gives banks the benefit of time-to-market offering a strategic advantage over competitors who lag in digital transformation.

Usability. Although hybrid cloud is a complex solution intrinsically, it can provide an appealing and user-friendly interface with smooth interaction patterns on the front-end. Even such a complex function as face recognition implemented on a hybrid cloud can be accessed by multiple customers at the same time, no matter their location or device.

Focus on customers’ environment. Hybrid cloud lets banks ensure a personal approach with regard to the platform a customer uses. Cloud for banking applications allows banks to create an app for every platform, whether it’s iOS, Android, Windows, macOS, etc.

Collaboration. A bank hybrid cloud solution facilitates cooperation between units of an organization, ensuring instant communication and coordination between the key parties of the process by accessing and collaborating via a single cloud platform.

Increased security. A bank hybrid cloud is a way to separate your sensitive data from low-risk data. The solution lets banks keep a lid on security risks by hosting high-risk data in a private cloud and moving low-risk data to a public cloud, facilitating scalability.

Access to deeper analytics. A hybrid cloud lets organizations collect and store data virtually and enjoy the capability to analyze it and even build machine learning algorithms to glean valuable insights that they can apply to upsell and provide better services.

Continuous service. A bank hybrid cloud solution lets banks serve their clients 24 hours a day, avoiding unplanned downtimes. Given that banks can freely access data from the cloud, they can provide an acceptable level of service at all times.

READ ALSO: Why Ukraine is a Safe Choice When it Comes to IoT Development

Our list of hybrid cloud benefits is far from being exhaustive. In their research for Business Value, IMB emphasizes the following benefits of cloud computing in banking and financial services:

- A lower total cost of ownership;

- Higher operational efficiency;

- Facilitating innovation;

- More flexibility to meet customer expectations;

- The emergence of new business models.

Bank hybrid cloud benefits: Afterword

In the light of a shift to remote work and digitalization trends of recent years, it’s vital for banks to move away from costly legacy infrastructures and adopt cost-effective and robust public clouds. A hybrid cloud in banking truly shines when a financial organization needs both a stronghold for high-risk financial data and a possibility to scale.

At nCube, we help companies access the tech talent they need on their digital transformation journey. With our model, we have been able to work with multiple clients operating in the banking sector. Talk to our experts if you need a team to develop bank hybrid cloud software. We’ll be happy to build your own development team in Kyiv, Ukraine. Let’s connect.

Recommended articles